As a Hudson’s Bay employee affected by the CCAA filing, you’re likely classified as an unsecured creditor with limited severance rights. Your entitlements differ from standard layoffs, with payments delayed until after secured creditors. The Wage Earner Protection Program may provide up to $8,844.22 in compensation for unpaid wages and severance. Third-party vendor employees and unionized workers may have additional protections. Understanding your specific employment situation will reveal your best options for financial recovery.

Understanding Hudson’s Bay’s CCAA Filing and Its Impact on Employees

When Hudson’s Bay filed for protection under the Companies’ Creditors Arrangement Act (CCAA), it fundamentally changed the rules for how its 9,300 employees will be treated during the company’s liquidation.

Under normal circumstances, you’d be entitled to termination pay and potentially severance, but CCAA proceedings alter this landscape considerably.

The court has approved the liquidation of 90 out of 96 stores, expected to finish by June.

Unfortunately, most employees won’t receive severance payments as they’ve become unsecured creditors—meaning they’ll only be paid after banks and secured creditors receive their share.

The corporate bankruptcy shield leaves thousands of workers last in line while banks collect their due.

While select management received retention bonuses, the vast majority of workers must now turn to government programs like Employment Insurance and the Wage Earner Protection Program for limited financial relief.

Severance Entitlements in Regular Layoffs vs. Bankruptcy Situations

The stark reality of bankruptcy layoffs creates a fundamentally different legal situation compared to standard workforce reductions.

When a company files for creditor protection under CCAA like Hudson’s Bay has done, employees shift from being protected workers to unsecured creditors, drastically changing their entitlements.

In this transformed legal landscape:

- Standard severance calculations (potentially up to 24 months of pay) no longer apply when a company enters bankruptcy proceedings.

- Employees fall to the bottom of the payment priority list, with secured creditors (typically banks) paid first.

- Government programs like WEPP become critical, though they cap benefits at $8,844.22, far less than what many long-service employees would normally receive.

The Wage Earner Protection Program: What You Can Claim

For many Hudson’s Bay employees facing job loss due to the company’s bankruptcy filing, the Wage Earner Protection Program (WEPP) represents a critical financial safety net. This federal program specifically compensates employees affected by employer bankruptcy or receivership.

Through WEPP, you can claim unpaid wages, vacation pay, termination pay, and severance pay earned within six months before the bankruptcy filing. However, there’s a maximum benefit cap of $8,844.22 for 2025.

You’ll need to formally apply after receiving your termination notice and the bankruptcy trustee has verified your claim. Keep all employment records, including pay stubs and contracts, to support your application.

Remember that WEPP won’t necessarily cover your full entitlement, but it offers some protection when regular severance isn’t available.

Special Considerations for Third-Party Vendor Employees

Unlike Hudson’s Bay employees directly impacted by the CCAA filing, third-party vendor staff stationed within department stores face a markedly different legal situation.

If you work for companies like Estée Lauder or MAC Cosmetics inside Hudson’s Bay locations, you’re likely entitled to full severance protection under common law, regardless of the department store’s financial troubles.

To determine your legal standing and entitlements:

- Check your employment documentation (pay stubs, T4s, contracts) to confirm your actual employer.

- Contact your employer’s HR department immediately to understand their continuity plans.

- Consult with an employment lawyer if your third-party employer attempts to withhold severance by citing Hudson’s Bay’s bankruptcy.

Your severance rights depend on who signs your paychecks, not where you physically work.

Don’t assume your legal position mirrors that of Hudson’s Bay employees.

Union Membership and Its Protective Benefits

While most Hudson’s Bay employees face uncertain financial futures during the company’s CCAA proceedings, union membership provides critical protections that non-unionized workers simply don’t have.

Approximately 647 Hudson’s Bay employees are unionized, giving them significant advantages during this difficult shift.

If you’re a union member, your collective agreement likely contains specific provisions for layoffs, including established severance formulas, recall rights, and negotiated notice periods.

These protections can’t be easily disregarded, even in bankruptcy proceedings. Your union representatives will advocate on your behalf throughout the CCAA process, ensuring your rights are protected.

To confirm your union status, check your pay stubs for union dues deductions or contact your workplace representative immediately for guidance on your specific protections.

Practical Steps to Take If You’re Affected by the Closure

Once you discover your employment at Hudson’s Bay is ending, you’ll need to take immediate action to protect your financial interests.

Don’t delay in gathering documentation about your employment history, including your start date, position details, and compensation information.

Immediately collect all employment records, noting hire date, positions held, and pay details for your protection.

- Apply for Employment Insurance (EI) immediately after your last day of work to minimize gaps in your income, as benefits can provide up to 55% of your earnings for up to 45 weeks.

- Register for the Wage Earner Protection Program (WEPP) once you’re formally terminated, which may compensate you for unpaid wages, vacation pay, and some termination/severance pay.

- Consult with an employment lawyer, especially if you work for a third-party vendor inside Hudson’s Bay, as you may be entitled to full severance.

How the Proposed Sears Act Could Change Bankruptcy Protections

The Sears Act represents a potential sea change in how employees are treated during corporate bankruptcies.

Unlike the current system, where workers become unsecured creditors who typically receive little to nothing, this proposed legislation would classify employees as secured creditors during bankruptcy proceedings.

This change would give workers priority status, considerably increasing their chances of receiving owed severance pay, termination pay, and pension benefits.

The act was inspired by the Sears Canada collapse, where thousands of employees lost their jobs without adequate compensation, while secured creditors were paid first.

If passed, this legislation could directly benefit Hudson’s Bay employees and anyone facing similar situations in the future, creating a more equitable process that recognizes workers’ contributions rather than treating them as last in line.

How Taylor Janis Can Help Protect Your Livelihood and Rights

Facing the uncertainty of bankruptcy layoffs, you’ll need experienced legal guidance to protect your employment rights and potential compensation options.

In times of mass layoffs, our experienced team evaluates each case individually to ensure you receive fair compensation for unfair severance.

Taylor Janis Workplace Law specializes in protecting employees during these challenging shifts, helping you understand your specific situation and available remedies.

Our employment law services include:

- Evaluating your legal position – determining if you’re entitled to full severance (especially if employed by third-party companies within Hudson’s Bay)

- Calculating fair compensation – assessing what you’re owed based on factors like years of service, position, and age

- Strategic representation – employing tactful negotiation when possible and decisive litigation when necessary

If you’re facing wrongful or constructive dismissal, dealing with human rights violations, or simply need clarity about your entitlements during bankruptcy proceedings, seeking professional legal guidance can make a significant difference in protecting your livelihood.

Our main hub for British Columbia is located in the heart of Vancouver. We also have a Kamloops Office for interior residents. That said, we serve the entire province of BC. We have the infrastructure to work with any of our clients virtually — even the furthest regions of British Columbia.

Call (604) 423-2646 [toll free 1-877-402-1002] to get routed to the best representative to serve you or contact us online for general inquiries.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take as well as what to expect moving forward.

Our offices are generally open 8:30 a.m.—4:30 p.m., Mon—Fri.

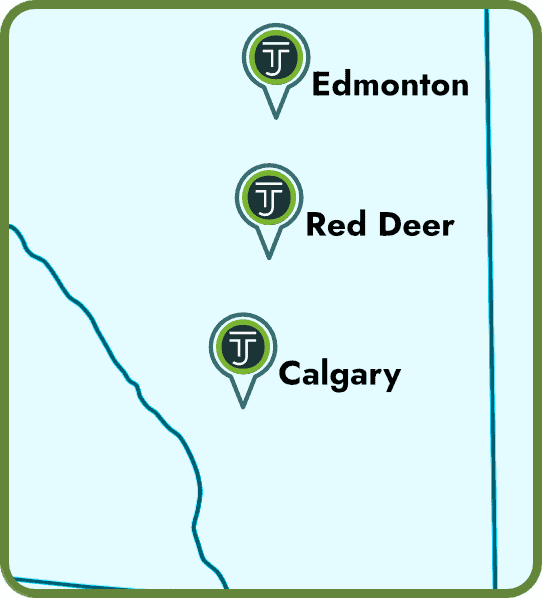

We currently have three offices across Alberta — Edmonton, Calgary, and Red Deer. We serve the entire province of Alberta (and BC). We also have the infrastructure to work with any of our clients virtually — even the furthest regions of Alberta.

Call 1 (844) 224-0222 (toll free) to get routed to the best office for you or contact us online for general inquiries.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take as well as what to expect moving forward.

Our offices are generally open 8:30 a.m.—4:30 p.m., Mon—Fri.

Preet Mandair

WORKPLACE LAWYER

Preet practices labour law, employment law, civil litigation, and workplace human rights at our Vancouver office. Drawing on her experience, she provides practical and strategic advice across all workplace legal matters by carefully assessing each client’s unique needs. Preet advocates for her clients in a methodical and effective manner, delivering results-focused representation in employment-related challenges.

PRIVACY NOTICE: Any information you provide to our office — whether your personal information or employment/employer details — will be treated as strictly confidential and will not be disclosed to your employer or to any other third party. So, please be reassured that you can talk openly to our capable Intake Paralegals worry free. Fill out an Online Inquiry or call us now, your information will be in safe and helping hands.

The Legal Review Process by Taylor Janis Workplace Law

- Taylor Janis strives for high-quality, legally verified content.

- Content is meticulously researched and reviewed by our legal writers/proofers.

- Details are sourced from trusted legal sources like the Employment Standards Code.

- Each article is edited for accuracy, clarity, and relevance.

- If you find any incorrect information or discrepancies in legal facts, we kindly ask that you contact us with a correction to ensure accuracy.