As a TD Bank employee affected by the 2025 restructuring, you’re entitled to significant severance protections under the Canada Labour Code. Your package should include base salary, bonuses, commissions, and benefits continuation – potentially extending up to 24 months of compensation. Don’t sign any agreements without reviewing your full entitlements, as initial offers are often negotiable. Consulting an employment lawyer can help guarantee you maximize your severance package and understand additional available benefits during this change.

Understanding TD Bank’s 2025 Restructuring Plan

As TD Bank prepares for significant changes in 2025, the restructuring plan centers on reducing its workforce by approximately 2,000 employees, representing 2% of its total staff.

The bank expects to save up to C$650 million annually through this initiative, which includes winding down its U.S. point of sale financing business.

You’ll see the impact of CEO Ray Chun‘s strategic review, which focuses on simplifying operations through automation and process re-engineering.

The bank’s expecting pre-tax restructuring charges between C$600 million and C$700 million over several quarters.

While the geographic distribution of layoffs hasn’t been specified, these changes come after TD’s historic anti-money laundering settlement in the U.S.

More details about the restructuring plan will be revealed at TD’s investor day in September.

Your Legal Rights as a TD Employee During Layoffs

With TD Bank’s restructuring plan taking shape, employees should understand their substantial legal rights under Canadian law.

As a federally regulated bank employee, you can’t be dismissed without just cause, and you’re entitled to significant protections under the Canada Labour Code.

You don’t need to accept the first severance package offered – you might be entitled to up to 24 months of pay, including bonuses and benefits.

If you’re terminated, you have the right to file an unjust dismissal complaint, which could result in reinstatement or additional compensation.

Don’t sign any agreements without legal review, as you’ll have up to two years to claim your full severance entitlements.

Key Severance Pay Components and Calculations

Several key components make up TD Bank’s severance pay calculations during the 2025 restructuring.

Your total severance package typically includes your base salary, bonuses, commissions, and benefits for up to 24 months, depending on factors like your age, position, and years of service.

Under federal regulations governing banks in Canada, you’re entitled to more protection than provincial employment standards provide.

- Base severance calculation starts with your regular compensation, including salary and consistent overtime pay patterns.

- Additional components factor in annual bonuses, commissions, and performance incentives you’d have earned.

- Benefits continuation covers health insurance, pension contributions, and other perks you’d normally receive.

If you’re in a specialized or senior role, you might qualify for enhanced severance due to limited comparable job opportunities in the market.

Federal Labour Code Protections for Bank Employees

Bank employees at TD enjoy stronger job protections than most workers because they’re governed by the Canada Labour Code rather than provincial employment laws.

Under this federal legislation, you can’t be dismissed without just cause, as confirmed by the Supreme Court in Wilson v Atomic Energy of Canada Ltd.

If you’re terminated, you have the right to file an unjust dismissal complaint under Division XIV of the Code.

Through this process, you could receive substantial remedies, including reinstatement to your position and compensation for lost wages from your termination date.

You’re also entitled to recover damages for bonuses, benefits, share ownership plans, and pension contributions.

While you’re expected to look for new employment, the specialized nature of banking positions may limit your ability to find comparable work.

Maximum Severance Benefits You Can Claim

TD employees can claim up to 24 months of severance pay, which includes not just your base salary but also bonuses, commissions, and other forms of compensation you’ve earned.

As a federally regulated bank employee, you’re protected by the Canada Labour Code, which provides stronger job security than provincial laws. Your maximum severance entitlement depends on factors like your age, position level, years of service, and the challenge of finding comparable employment.

- Senior executives and specialized roles can typically claim 18-24 months of total compensation.

- Mid-level managers and professionals often qualify for 12-18 months of severance benefits.

- Even entry-level positions may receive 6-12 months when considering all relevant factors.

Don’t accept TD’s initial severance offer without reviewing your full entitlements under federal labour laws.

Critical Steps Before Signing Severance Agreements

When you’re handed a severance agreement from TD Bank, taking immediate action can protect your rights and maximize your benefits.

Don’t feel pressured to sign immediately – you have the right to review the agreement thoroughly.

First, gather all relevant documentation, including your employment contract, performance reviews, and compensation details.

Next, calculate your total years of service and document any special circumstances that might affect your severance, such as recent promotions or specialized skills.

Consult an employment lawyer who specializes in federally regulated banking before signing anything.

They’ll review whether the severance package reflects your full entitlements under the Canada Labour Code.

Common Employer Tactics to Watch For

During severance negotiations, employers often use strategic tactics to minimize their financial obligations. When facing a TD Bank layoff, you’ll need to be aware of common practices that could affect your severance entitlements.

Watch for pressure to sign agreements quickly or accept initial offers without proper review.

- Employers may impose artificial deadlines for signing severance agreements, but these aren’t legally binding under Canadian law.

- TD might try to exclude certain compensation components like bonuses or commissions from your severance calculation.

- The bank could attempt to misclassify your employment status or length of service to reduce severance obligations.

Remember that as a federally regulated bank employee, you have significant legal protections under the Canada Labour Code.

Don’t let urgency or pressure tactics compromise your right to fair compensation during a layoff.

Additional Compensation Beyond Base Severance

Severance packages often include substantial compensation beyond your base salary that many employees overlook during negotiations.

During TD layoffs, you’re entitled to the value of your complete compensation package, including bonuses, commissions, stock options, and benefits continuation. Don’t forget about unredeemed vacation pay, accumulated overtime, and pending expense reimbursements.

You should also carefully review any deferred compensation, pension contributions, and long-term incentive plans. If you’re laid off near bonus season, you may be entitled to pro-rated bonuses for the partial year worked.

Additionally, your health and dental benefits should continue through the severance period. Make sure your severance agreement addresses company car allowances, professional membership dues, and any other perks you’ve received during your employment.

Negotiating Enhanced Severance Packages

Although TD Bank may present an initial severance offer during layoffs, you’ll often have room to negotiate a more favourable package that better reflects your contributions and circumstances.

As a federally regulated bank employee, you’re protected by the Canada Labour Code, which provides stronger termination protections than provincial laws. Your negotiating position is particularly strong if you’ve been with TD for several years or hold a specialized role.

- Consider requesting additional months of severance beyond the initial offer, especially if you’re in a senior position or over 40 years old.

- Negotiate for continued health benefits, pension contributions, and retention of stock options during the severance period.

- Ask for outplacement services, a positive reference letter, and agreement on how your departure will be communicated internally and externally.

Conclusion

If you’re facing a TD Bank layoff in 2025, don’t rush to accept the first severance offer. You’re entitled to substantial compensation under federal labour laws, and you’ve got time to negotiate. Review all documents carefully, understand your full rights, and consider seeking legal counsel before signing anything. Remember, your final severance package should reflect your years of service, position, and total compensation structure.

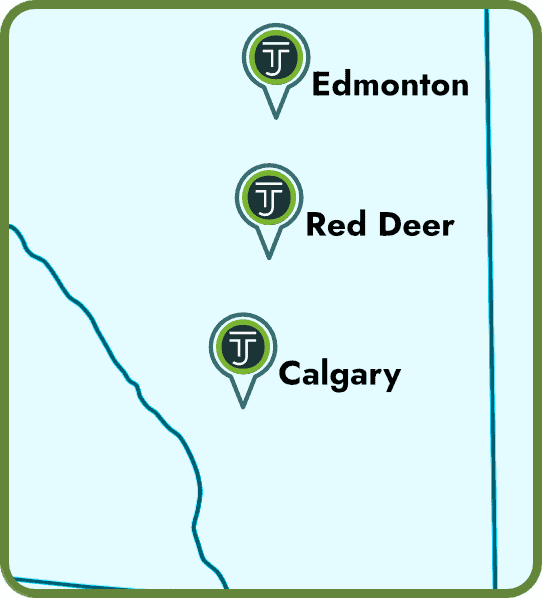

We currently have three offices across Alberta — Edmonton, Calgary, and Red Deer. We serve the entire province of Alberta (and BC). We also have the infrastructure to work with any of our clients virtually — even the furthest regions of Alberta.

Call 1 (844) 224-0222 (toll free) to get routed to the best office for you or contact us online for general inquiries.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take as well as what to expect moving forward.

Our offices are generally open 8:30 a.m.—5:00 p.m., Mon—Fri.

Our main hub for British Columbia is located in the heart of Vancouver. We also have a Kamloops Office for interior residents. That said, we serve the entire province of BC. We have the infrastructure to work with any of our clients virtually — even the furthest regions of British Columbia.

Call (604) 423-2646 [toll free 1-877-402-1002] to get routed to the best representative to serve you or contact us online for general inquiries.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take as well as what to expect moving forward.

Our offices are generally open 8:30 a.m.—5:00 p.m., Mon—Fri.

Colin Flynn

WORKPLACE LAWYER

Colin is an experienced lawyer practicing in the areas of Labour & Employment, Civil Litigation, Estate Litigation, Corporate & Commercial Litigation, and Personal Injury. He places high emphasis on developing trusted relationships with his clients, ensuring they feel comfortable and at ease sharing the subtleties of their circumstances.

PRIVACY NOTICE: Any information you provide to our office — whether your personal information or employment/employer details — will be treated as strictly confidential and will not be disclosed to your employer or to any other third party. So, please be reassured that you can talk openly to our capable Intake Paralegals worry free. Fill out an Online Inquiry or call us now, your information will be in safe and helping hands.

The Legal Review Process by Taylor Janis Workplace Law

- Taylor Janis strives for high-quality, legally verified content.

- Content is meticulously researched and reviewed by our legal writers/proofers.

- Details are sourced from trusted legal sources like the Employment Standards Code.

- Each article is edited for accuracy, clarity, and relevance.

- If you find any incorrect information or discrepancies in legal facts, we kindly ask that you contact us with a correction to ensure accuracy.